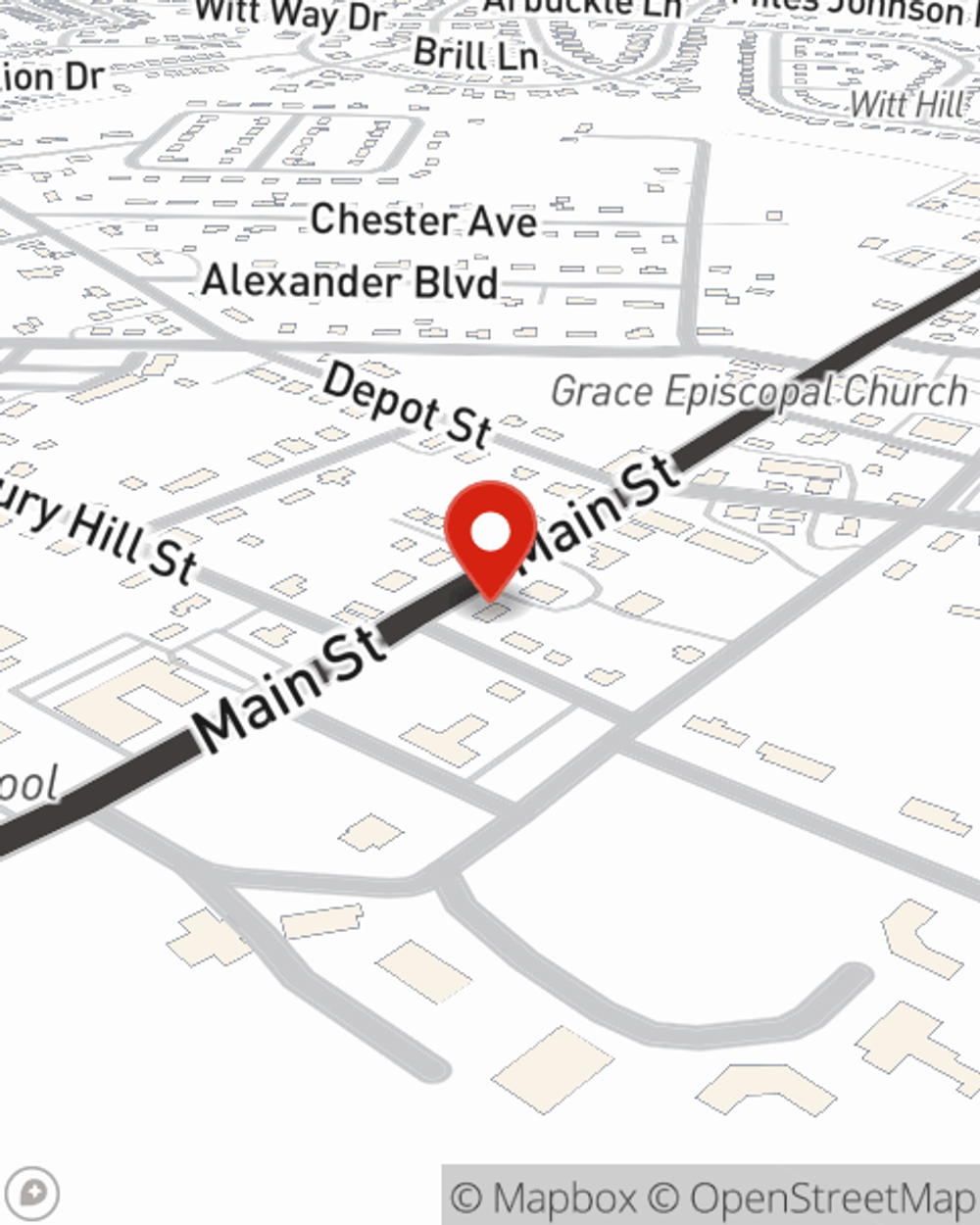

Business Insurance in and around Spring Hill

Calling all small business owners of Spring Hill!

Helping insure small businesses since 1935

- Columbia

- Arrington

- College Grove

- Thompsons Station

- Mt. Pleasant

- Primm Springs

- Williamsport

- Chapel Hill

- Duck River

- Williamson County

- Maury County

- Rutherford County

Insure The Business You've Built.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Mishaps happen, like an employee gets injured on your property.

Calling all small business owners of Spring Hill!

Helping insure small businesses since 1935

Keep Your Business Secure

Planning is essential for every business. Since even your most detailed plans can't predict consumer demand or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like errors and omissions liability and business continuity plans. Fantastic coverage like this is why Spring Hill business owners choose State Farm insurance. State Farm agent Chris Nielsen can help design a policy for the level of coverage you have in mind. If troubles find you, Chris Nielsen can be there to help you file your claim and help your business life go right again.

Don’t let concerns about your business stress you out! Reach out to State Farm agent Chris Nielsen today, and find out how you can meet your needs with State Farm small business insurance.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Chris Nielsen

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.